Welcome to the Industry Overview Series Blogs – Issue One

Building on our previous discussion of market access in China and the United Kingdom, this post focuses on the latest trade data and key policy developments influencing both markets. As healthcare systems across the world become more connected, understanding the flow of medical products between countries is increasingly important for identifying both challenges and areas of opportunity.

Brief Summary:

Based on official statistics and recent policy documents, the positions of China and the UK in the global medical device supply chain can be clearly identified. China demonstrates strong performance in the export of low-cost disposable consumables and has developed the capability to export high-end imaging equipment such as CT and MRI systems. The UK, on the other hand, shows strengths in certain niche areas of medical technology, particularly in innovative diagnostic solutions.

These structural differences reflect the characteristics of each country’s industry and point to opportunities for complementary cooperation in the future.

Industry Trade Analysis: China

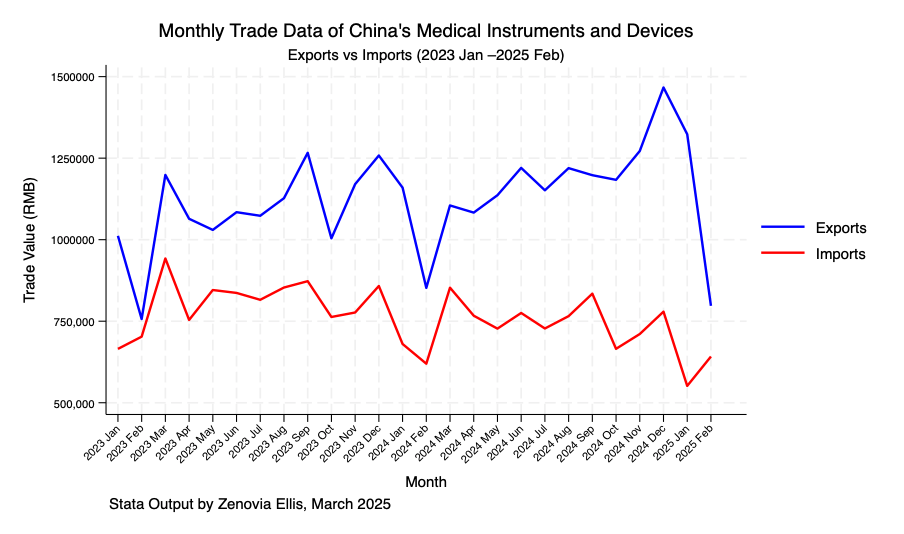

Based on the data published by the General Administration of Customs of the People’s Republic of China, covering the period from 2023 to the end of March 2025, the following observations have been made (figures calculated in RMB):

Throughout this period, the total export value of medical devices consistently exceeded the import value. This indicates that China holds the position of a net exporter in the global medical device market.

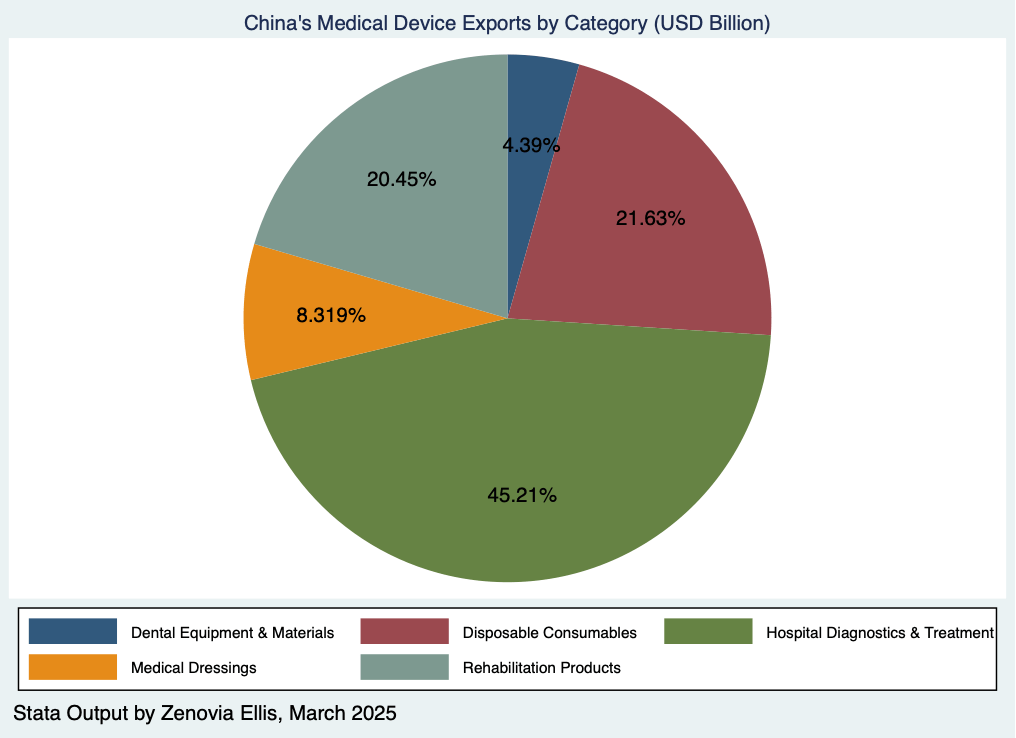

According to data compiled by the China Chamber of Commerce for Import and Export of Medicines and Health Products, from January to October 2024, China recorded a significant trade surplus in categories such as medical dressings, disposable consumables, and health rehabilitation products. In these segments, exports far exceeded imports. The competitiveness of these products remains largely driven by low pricing, relying on large-scale supply and cost efficiency to maintain international market share. However, overall brand influence and recognition in the high-end market remain relatively limited.

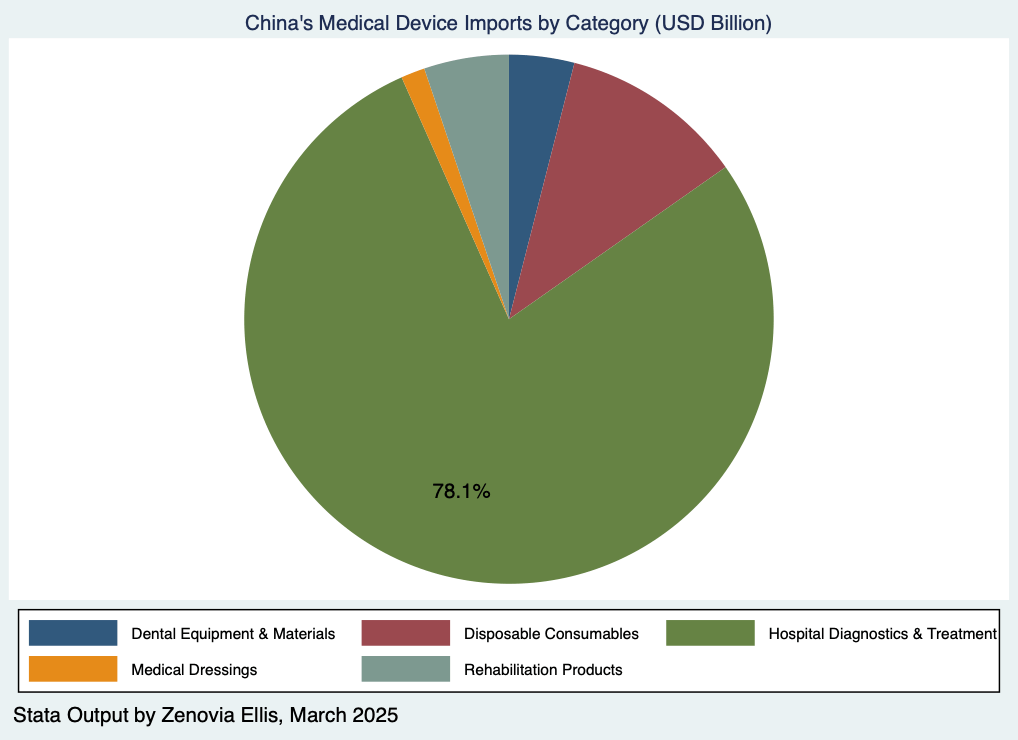

In contrast, hospital diagnostic and treatment equipment recorded an export value of USD 17.87 billion, accounting for 45.22 percent of total medical device exports. Most of these exports were endoscopes. Despite the high export volume, many high-end devices and critical components still rely heavily on imports. In fact, imports of diagnostic and treatment reached USD 23.19 billion, making up 78.1 percent of China’s total medical device imports. This highlights an ongoing dependence on foreign technology in high-risk, high-precision equipment, reflecting structural challenges in domestic innovation and supply capability.

Industry Trade Analysis: UK

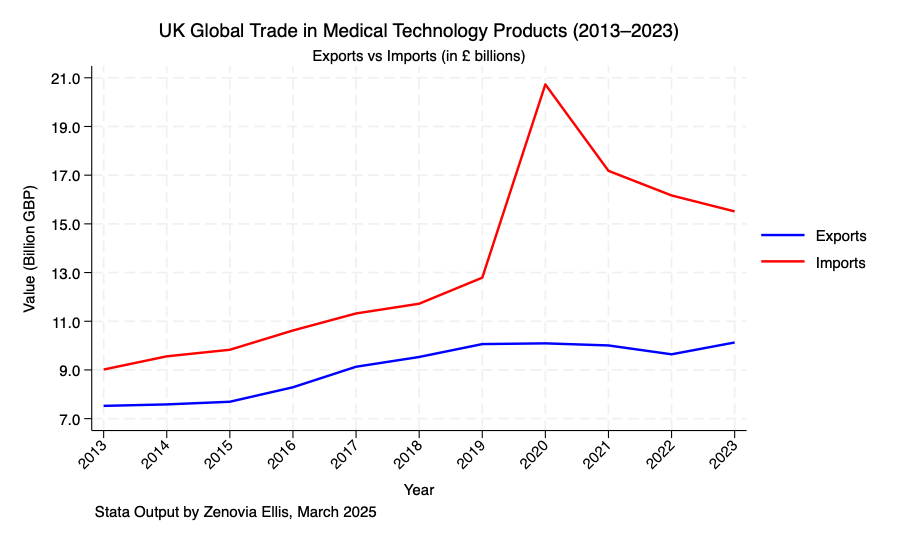

Based on data extracted from the UK government’s Life Sciences Competitiveness Indicators 2024: Data Tables, the following analysis can be made:

From 2013 to 2023, the United Kingdom’s import and export volumes of medical devices have shown steady growth. This reflects the country’s gradual expansion in international medical device trade. However, a persistent and widening trade deficit remains, highlighting the need to further increase export opportunities for UK-based companies to improve the current balance.

During the COVID-19 pandemic, a sharp rise in imports was observed, while exports remained relatively stable. This indicates potential gaps in the development of basic medical infrastructure and low-end medical devices in the UK. The severe shortage of essential medical equipment and personal protective equipment (PPE) during the early stages of the pandemic caused considerable concern among frontline healthcare workers. The surge in imports in 2020 exposed vulnerabilities within the UK healthcare system. While the medical industry fundamentally relies on high-end technology, the strength of foundational infrastructure often determines how well advanced systems can be supported. This suggests there is still room for development in the UK’s mid- and low-end medical device sectors.

Moreover, even after the pandemic, import levels have remained slightly above pre-pandemic levels. This trend may reflect the UK’s efforts to build reserves of essential medical equipment, further emphasizing the importance of strengthening domestic production capabilities in basic healthcare technologies.

Policy Implications and Strategic Insights

Based on the trade data discussed earlier, this section looks at how recent policy shifts and industry patterns reveal underlying challenges and opportunities in the UK–China medical device market. The aim is to better understand current dynamics and identify areas where collaboration could create mutual value.

1. Supply Chain Resilience

In its Medical Technology Strategy under Priority 1, the UK government highlights a key challenge: as access to low-cost raw materials becomes more limited, risks associated with resource shortages and price volatility are increasing. This has led to more frequent and severe disruptions that affect the quality and safety of patient care. Enhancing resource security and improving usage efficiency have become urgent priorities.

Against this backdrop, China demonstrates clear cost and supply advantages in the production of mid- and low-end medical devices, particularly in disposable consumables such as respiratory tubes. Backed by a mature industrial chain and large-scale manufacturing capacity, Chinese suppliers can help ease the pressure on the UK healthcare system caused by domestic labour shortages. These imports may also help address persistent supply gaps in basic medical equipment across the UK.

2. Market Concentration and Entry Barriers

China’s high-end medical device market remains largely controlled by multinational giants such as Medtronic. This concentrated structure has two main consequences.

First, it limits the availability of products that combine competitive pricing with meaningful technological innovation. This issue is particularly evident in newer segments like AI-driven diagnostics and remote patient monitoring, where the range of suppliers and technical solutions is still relatively narrow.

Second, many UK-based small and medium-sized enterprises are still at an early stage of growth and lack access to a complete industrial chain. Without sufficient resources, established distribution networks, or regulatory experience, they often struggle to enter more competitive and tightly regulated markets like China. These barriers make it difficult for them to scale internationally, limiting their growth beyond domestic or regional markets.

3. Community Health and Diagnostic Collaboration

Under Priority 4 of the same strategy, the UK identifies two key areas of medical technology that would benefit from greater focus: community healthcare technologies and diagnostics. Many products commonly used in community healthcare — such as glucose test strips and urine ketone test papers — are single-use consumables. Expanding the range of product choices and improving comparability are among the NHS’s future development goals.

In diagnostics, imaging services represent an area where the UK could consider importing CT and MRI systems from China, where manufacturers have developed strong capabilities. Strategically importing essential diagnostic and general treatment equipment from China could help improve the efficiency of the UK’s healthcare infrastructure. At the same time, the UK can expand its exports of innovative, high-end medical technologies in specialized areas, such as prostate imaging systems. Promoting two-way medical device trade between China and the UK is an effective pathway to strengthen industry competitiveness and improve resource allocation on both sides.

Additionally, on 6 February 2024, NHS Supply Chain introduced a new Dynamic Purchasing System (DPS) for medical technology innovation. Designed to streamline procurement processes and lower entry barriers, this system opens up more accessible pathways for small and medium-sized enterprises. It presents a valuable opportunity for innovative Chinese medical device companies seeking to enter the UK market, especially in fields such as community care, disposable medical products, and digital health technologies, where strong collaboration potential exists.

Leave a comment